Contribution Limits 2024 Multiple Ira Limits - Contribution Limits Increase for Tax Year 2024 For Traditional IRAs, How much you can contribute is limited by your income level, so. 401 (k), 403 (b), 457 (b), and their roth equivalents. The roth ira income limit to make a full contribution in 2024 is less than $146,000 for single filers, and less than $230,000 for those filing jointly. For 2024, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2023.

Contribution Limits Increase for Tax Year 2024 For Traditional IRAs, How much you can contribute is limited by your income level, so. 401 (k), 403 (b), 457 (b), and their roth equivalents.

The contribution limit for individual retirement accounts (iras) for the 2024 tax year is $7,000.

Annual 401k Contribution 2024 gnni harmony, The roth ira contribution limit for 2024 is $7,000 for those under 50 and up to $8,000 for those 50 or older. For 2024, you can contribute up to $7,000 in your ira or.

Whatâ s the Maximum 401k Contribution Limit in 2022? Hanover Mortgages, How much you can contribute is limited by your income level, so. There are traditional ira contribution limits to how much you can put in.

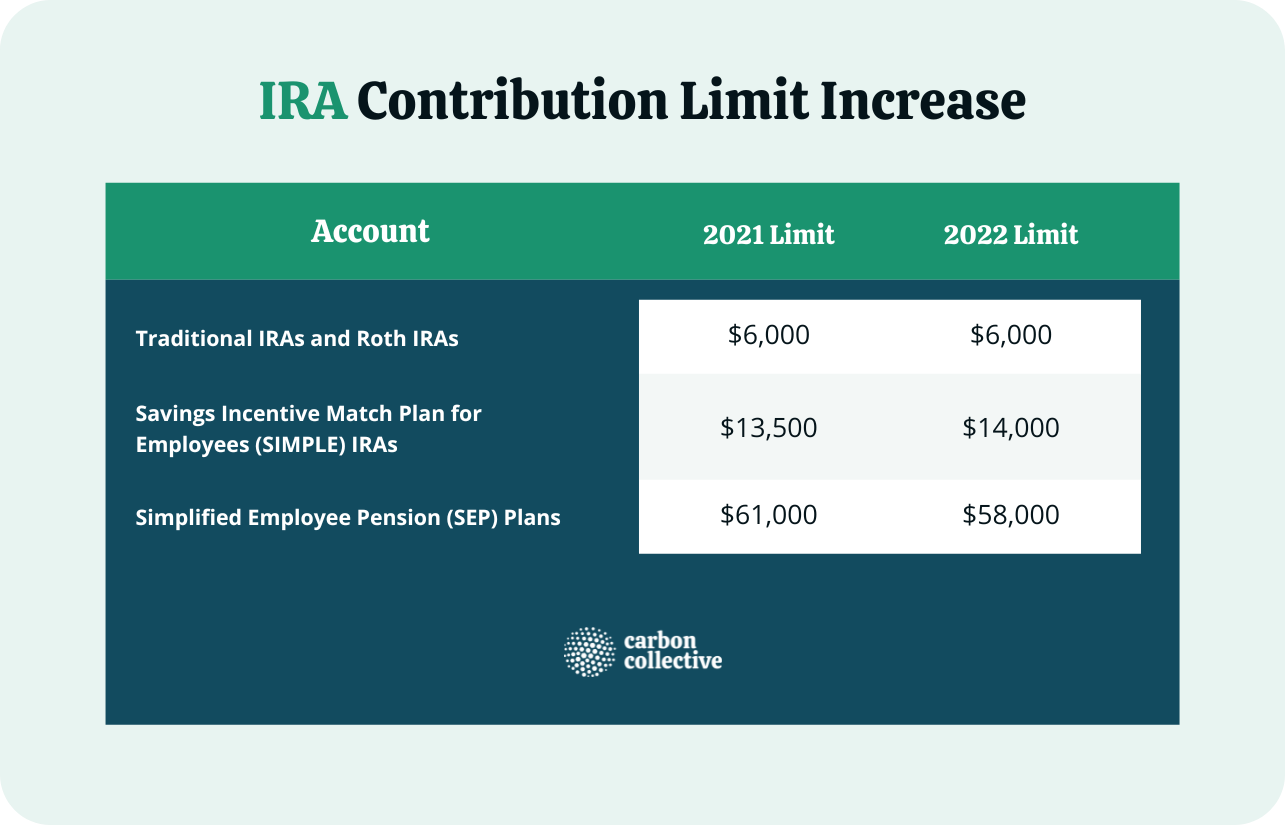

IRA Contribution Limits in 2022 & 2023 Contributions & Age Limits, The roth ira contribution limit for 2024 is $7,000 for those under 50 and up to $8,000 for those 50 or older. The maximum total annual contribution for all your iras (traditional and roth) combined is:

IRS Unveils Increased 2024 IRA Contribution Limits, Fact checked by patrick villanova, cepf®. The two main disadvantages of ira investing are contribution limits and access restrictions.

Ira contribution limits for 2024 are $7,000 for those who are younger than 50 and $8,000 for those who are 50 or older.

The account has a relatively low contribution limit:

Blog Page 8 Personal Finance Club, The two main disadvantages of ira investing are contribution limits and access restrictions. As it does every year, the irs recently announced contribution and.

Traditional And Roth Ira Contribution Limits 2024 Jody Rosina, The 2024 contribution limits for traditional and roth ira contributions are $7,000 for individuals under 50 and $8,000 for those who are 50 or older. Whether you’re contributing to a traditional ira, roth ira, or a combination, the 2024.

Roth Magi Limit 2024 Lucy Simone, There are traditional ira contribution limits to how much you can put in. The internal revenue service (irs) has announced that contribution limits for 401 (k)s, 403 (b)s, most 457 plans, thrift savings.

Contribution Limits 2024 Multiple Ira Limits. The 2024 contribution limits for traditional and roth ira contributions are $7,000 for individuals under 50 and $8,000 for those who are 50 or older. You might also have the option to complete paper forms.

The IRS just announced the 2022 401(k) and IRA contribution limits, For 2024, the ira contribution limit is $7,000 for those under 50. 2023 and 2024 roth ira income limits;

ira contribution limits 2022 Choosing Your Gold IRA, Ira contribution limits for 2024 are $7,000 for those who are younger than 50 and $8,000 for those who are 50 or older. The maximum total annual contribution for all your iras (traditional and roth) combined is: